On this edition of Your Call, we’re talking about Opportunity Zones. Tucked away in last year’s tax bill is a bipartisan effort to encourage investors to put their money into economically distressed areas. How would these zones shape the state’s neighborhoods?

States are about to decide which areas to designate. Some eligible places might surprise you -- do places like Alcatraz and Treasure Island really need to attract capital? We’ll find out how this policy could shape neighborhoods in your city. How can states encourage investment without incentivizing gentrification?

Guests:

Lisa Hall, impact investor and a senior fellow at Georgetown University’s Beeck Center for Social Impact and Innovation

Rachel Reilly, director of impact investing at the community development and affordable housing organization Enterprise Community Partners

Web Resources:

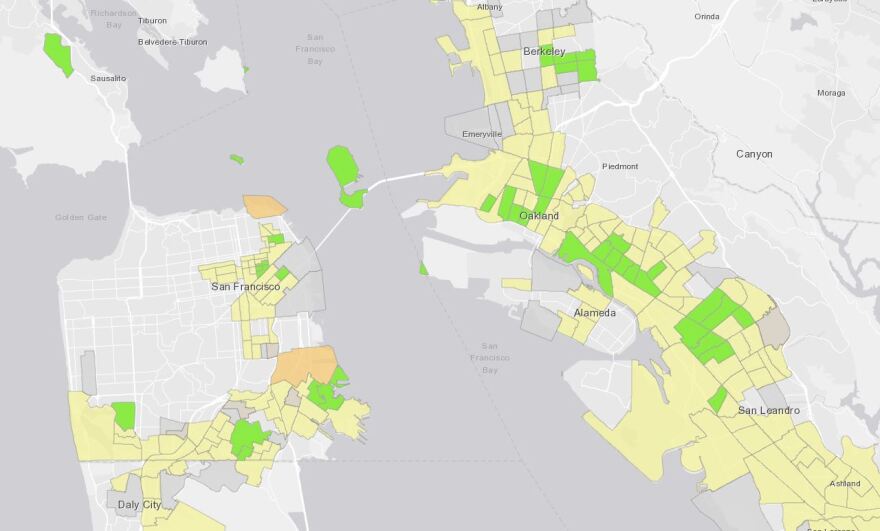

Map: Qualified Opportunity Zone Census Tracts

Beeck Center: In the Land of OZ (Opportunity Zones) Who Will Benefit?

New York Times: Tucked Into the Tax Bill, a Plan to Help Distressed America

The Intercept: New York Times Applauds Donald Trump for a New Attempt ant an Old Corporate Boondoggle

Brookings: Will Opportunity Zones help distressed residents or be a tax cut for gentrification?

Economic Innovation Group: Opportunity Zones