More than two million people are incarcerated in our country – the largest prison population in the world.

In the 80s and 90s, California was at the center of a push to “get tough on crime” – trying juveniles as adults, passing three strikes and tightening sentencing laws – as part of the war on drugs.

Between 1980 and 2011, California’s prison population grew 640 percent. In 2011, the U.S. Supreme Court decided the state’s prisons were dangerously overcrowded, and they ordered the Golden State to reduce the population.

California still incarcerates more than 130,000 adults, in its prisons and jails. But – beyond these statistics and headlines – what do we know about those living – sometimes for decades – inside the walls of California’s 34 adult prison facilities?

Today we launch the San Quentin Prison Report – a new series that brings you stories produced by men currently serving time in California’s oldest prison. You’ll hear firsthand how these men manage the various obstacles that are part of prison life. You’ll hear intimate conversations about restorative justice, the complex parole process; and keeping hope alive with and friends on the outside.

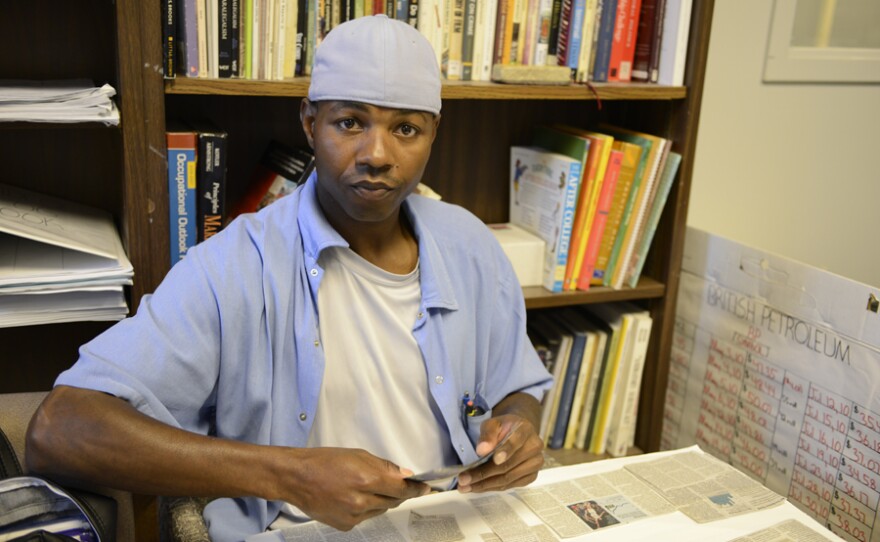

Our first story is about a young man who grew up homeless. He ended up in prison by age 17 and didn’t learn to read until his 20s. But here's the thing: After he started reading, what grabbed him was the business section of newspapers and financial publications, and in a relatively short amount of time, he gained a unique understanding of the stock market and personal finance. This is the story of Curtis Caroll, who is aptly nicknamed “Wall Street.” From San Quentin, Tommy Shakur Ross has that story.

Curtis Caroll is 34 years old, but he looks about 25. He's clean-cut, wearing dark shades and a grey baseball cap turned backwards. It's hard to imagine that he was homeless as a kid.

“My mother was a drug addict for many many years,” says Caroll. “We moved from place to place a lot. She used crack-cocaine for a long time since I was a kid. We got evicted out of our various homes that we lived in. We lived in missions, Christian homes, and churches and things like that for a while. Basically, we were homeless.”

And this affected his school life. He was kicked out of schools in both Oakland and Richmond. Perhaps he didn't learn to read because he would pay other students to do his homework and tests for him. In 1996, at age 17, he was arrested for murder.

“I remember I went to court and my lawyer was telling me about the case, and he had given me a bunch of papers to read, and he pretty much explained everything to me, and I just nodded my head like, ‘Yeah, I understand,’ but I really didn't,” Caroll says. “I thought, ‘Well, the tricks and things that I have used through the years to get people to do what I wanted them to do didn't work in this particular environment.’ ”

He was sentenced to 54 years to life and eventually ended up here at San Quentin. One day, when seeking out the sports page so that his cellmate could read it to him, he stumbled across the business section of newspaper.

“And I was like, ‘What's that?’ and he said, ‘Well, that's that paper in your hand,’ ” says Caroll. “And I said, ‘Stocks, what do you mean?’ He said, ‘Yeah, you know, this is a place, you know, Wall Street, where you can go and invest in stocks and make money.’ I was like, ‘Really? Can I do it from here?’ He said, ‘Yes, you can do it from anywhere.’ That’s what sparked it, that’s when I was like, ‘Let me see a little bit more about how this process works.’ ”

That spark lit a fire for young Curtis. He was assigned a tutor that provided him with Star Wars books to read, but it was the financial information that motivated him to learn.

“I guess I was about 19 or 20. When I started to learn how to read, financial publications were what I would read, “ Caroll says. “I was reading the business section of the newspaper. Although I was educating myself and trying to get my reading skills up, because I reading about finance, it kind of opened my eyes to what the world had to offer from a different perspective from the way I’ve always seen it.”

And people started seeing him differently too. In fact, he has become such a financial wizard that now everyone calls him “Wall Street.”

“The name Wall Street was given to me by a brother that I had met some years ago who was in one of the classes that I was teaching,” Caroll says. “It kind of defined the new me. They say that our name is usually a tag of what we've done in the past, so this new me and what I'm into with the finances, I think Wall Street kind of fit perfect with the re-invented.”

Wall Street became such an expert in finance, that prisoners began asking him to teach them. Now he teaches a class about personal finance and stock investing under the financial literacy division of the San Quentin Prison Report.

Caroll tells his students, “In prison you can buy stocks three ways. You can buy stock with what they call a direct investment purchase, which is considered a drip program that allows you to write the company directly. Then you have the other process, which is called going through an online discount brokerage. Then you have the way through a brokerage, where you have your folks on the streets where you have a broker who does the work for you.”

The curriculum he teaches is based on what he calls “the four timeless rules to personal finance.”

“Saving, cost control, borrowing prudently and diversification,” says Caroll.

He provides a practical example for prisoners.

“So saving would be a person in here who is not spending all his money at the canteen,” he say. “Cost control would be a person who says, ‘I have a hundred bucks, and I'm only going to spend $50 this month, and I'm going to save $50.’ Borrowing prudently means that you know you have the money before you borrow it, versus what someone else is going to give you. Diversification is allowing your money to do multiple functions. For example if you were working for PIA….”

PIA stands for Prison Industry Authority. It's a place where some prisoners work various jobs like making furniture, upholstery, mattress and bedding, while earning wages from a scale of 30 to 95 cents, with an average of about 75 cents an hour.

“And you were making money and getting a check, and then you were also a drawer, and you draw cards, and you sold cards on the side, that's diversification,” Caroll explains. “Not only are you getting a check from the PIA, you also are making money off the cards that you are doing from the drawings.”

Today Wall Street has a new perspective on criminality, thanks to his newfound knowledge about how the financial system works.

“For me, being a criminal and always having a criminal mentality about how to make money, financial education took that out of me because criminality no longer made sense anymore,” Caroll says. “It was like, now that I’m seeing it from a financial perspective, I’m now weighing my options about what’s worth it. It economically doesn’t make sense anymore to break the law.”

That’s quite a revelation for someone who once considered himself a criminal. Wall Street says he has a new outlook on life, but it’s not about greed.

“I don't worship money. I don't worship money and I don't love money,” Caroll says. “What money does for me is it’s a necessity to allow me to do the things that I’ve been striving to do in life as far as change, helping others and things like that.”

He insists that financial education is basically understanding how to manage money properly and how to make it work in a person’s life.

“So with a person who has been in the criminal element, you know, we never really lose where we come from. We just learn to morph into something else,” says Caroll. “But, if you're out there and don't have a way to produce, you tend to go back to what you know. To get rid of that totally, like I have, you educate yourself in finances; you never have to worry about that again. That's what I really want to get out there to the people.”

Word up, Wall Street. Keep hope alive.